If you’ve watched the news lately, you’ve seen that Oklahoma (along with many other states) is in a budget crisis. In Oklahoma, you hear about many programs that are most likely going to have cuts made to funding. Education is one cut being discussed, but that is something I know myself and many other Oklahomans don’t want to happen. It’s my opinion that in order for our state to grow and retain good jobs and companies, education needs to be at the top of the list of things to fund.

But first, what’s causing the current budget shortfall in Oklahoma?

In January, as reported by the Tulsa World (1), the State Board of Education in Oklahoma announced a $47 million cut to our education system. It attributed the cut to the falling price of oil. Here in Oklahoma, the impact has been felt by way of layoffs and budget deficits in companies across the state. Whether oil’s decline is the sole culprit of these cuts is a subject of much controversy, so I’ll instead focus on what’s ahead of us and how we might find new funding for education.

Possible Solutions

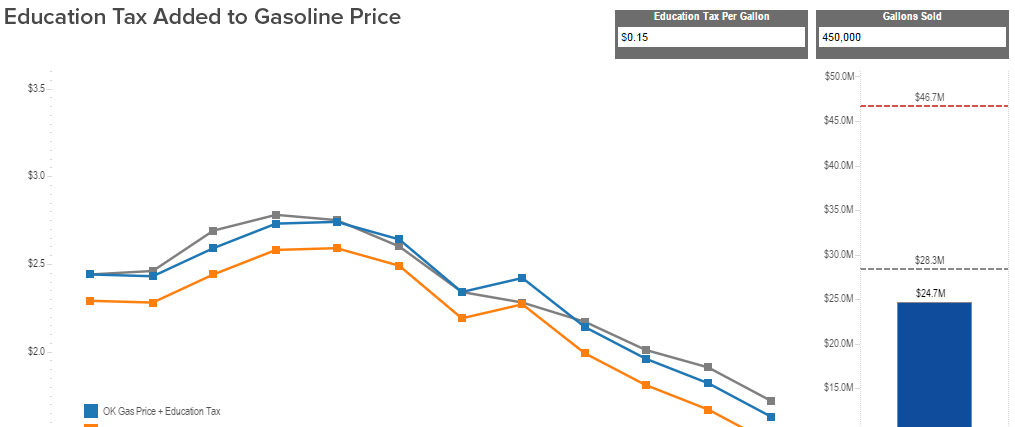

I’ve a noticed a trend on social media where people are tossing out ideas for how we could cover the deficit that we are facing. Bringing back car inspections, legalizing marijuana, adding a penny statewide sales tax, adding an education tax to gasoline, removing tax credits for large corporations to do business here, etc. Many of these could be good ideas for the state in general, but how much of an impact would they have on the deficit? I decided to focus in on the gasoline tax option and developed the dashboard below and analysis for perspective.

What Goes into Gas Prices?

The price we pay at the pump isn’t as straightforward as many would think. Many costs make up the price we pay. There are crude oil costs, refining costs, distribution and marketing costs, and federal and state taxes. The current federal taxes in Oklahoma are 18.4 cents, and the state taxes are 17 cents per gallon (2). If we were to add an education tax to the price of gas, this is where we would see the additional costs.

Two Options for an Education Tax on Gas

Along these lines, the dashboard below shows two different ideas that I’ve heard for adding an education tax to the low prices we enjoy here in Oklahoma. I couldn’t find statistics on the current volume of gas being sold from the EIA, which has withheld this to avoid disclosure of individual company data (3). They did, however, have statistics showing that we are likely between 400,000 to 600,000 barrels a day on average if you look at prior years. Here are the ideas followed by the Tableau dashboard:

- Adding a flat, simple tax to the price of gas (example 25 cents).

- Take the difference between the Oklahoma price and the U.S. national average, adding this as a tax to the price of gasoline (thus making Oklahoma’s price the national average).

Is It a Good Idea? You Decide.

In conclusion, if we added 25 cents to a gallon of gasoline and sold an average of 500,000 barrels per day, we would be close to covering the deficit that was placed in January over the course of a year.

I’m not advocating for anything to be done with this post, all I’m trying to do is show that there are other ways that we as citizens can assist with this problem without costing us a lot of money, benefiting our children and our state in the long run.

Sources:

- Tulsa World: http://www.tulsaworld.com/communities/sandsprings/oklahoma-public-schools-receive-additional-budget-cut/article_44d8175f-af58-5290-91f7-c8368ea04507.html

- Bankrate: http://www.bankrate.com/finance/taxes/gas-taxes-by-state.aspx

- EIA: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=A103620401&f=M

NOTE: Just recently, Oklahoma announced that they would tap into the state’s Rainy Day Fund to help counter the most recent education cut. Unfortunately, the money designated still isn’t near enough to cover the overall education shortfall, meaning that underfunding is still a big issue.